Ghana International Bank, London-based financial institution under the umbrella of the Bank of Ghana, has found itself embroiled in controversy after accusations surfaced regarding the manipulation of its financial reports to mask substantial losses.

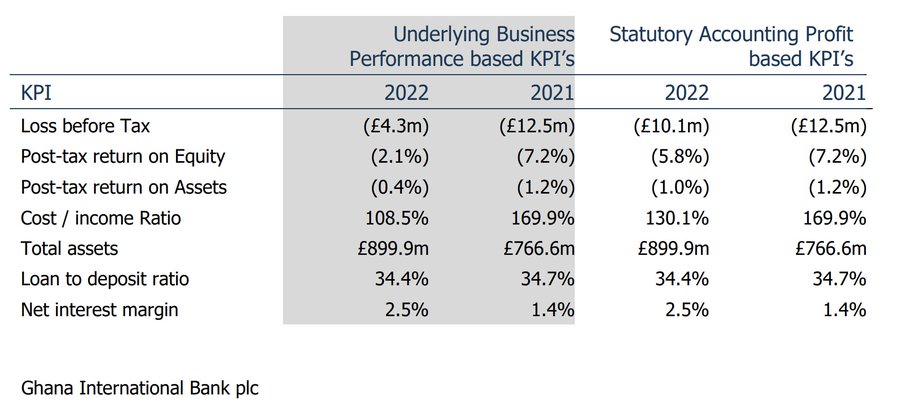

The allegations stem from a post by Mr. Bright Simons, Vice President of IMANI Africa, who highlighted the bank's apparent attempt to obscure its dismal financial performance. According to Simons, Ghana International Bank purportedly devised its own accounting standard to slash its reported losses by a staggering 60%, painting a misleadingly positive picture for the year 2022.

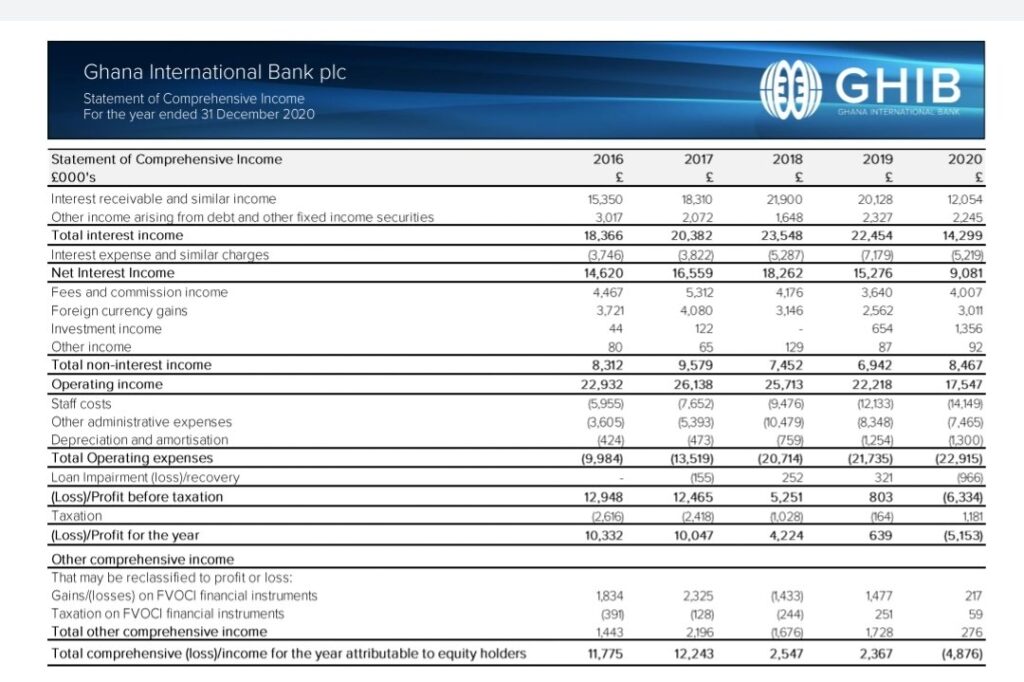

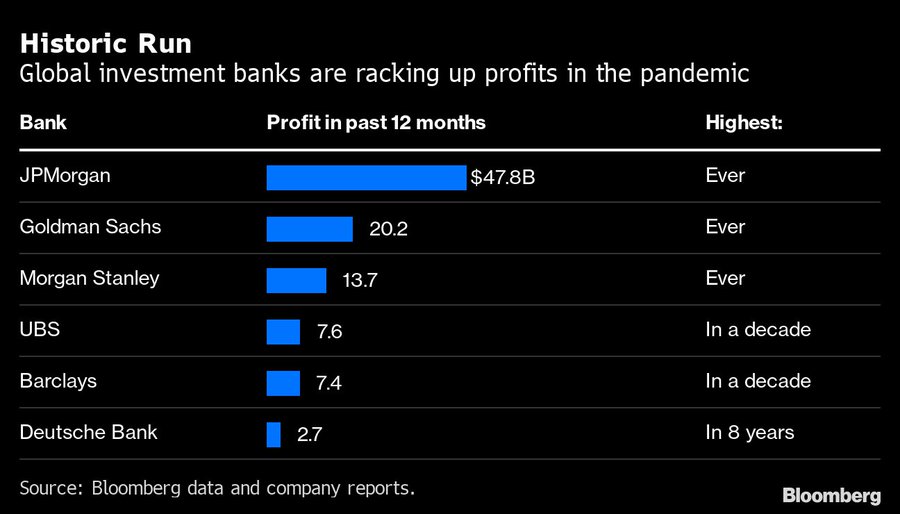

Referencing his earlier post from 2022, Simons pointed out the alarming trajectory of the bank's finances, noting a significant decline from profitability six years prior to substantial losses in recent times. Despite global banking trends showing modest dips followed by resurgences in profits, Ghana International Bank stood out with its stark downturn.

Of particular concern were the escalating staff costs incurred by the bank, which had tripled over the same period of financial decline. This juxtaposed with practices in the UK banking sector, where profitable institutions like Lloyds demonstrated prudent cost management strategies, further highlighting the discrepancies in Ghana International Bank's financial management.

Simons revealed that despite the bank's attempt to portray a more favourable operational situation with a reported operating loss of £4.3 million for 2022, the inclusion of investment losses actually inflated the total losses to approximately £12.17 million, surpassing the previous year's comprehensive loss.

The revelations have sparked widespread concern among financial experts and stakeholders, raising questions about transparency, accountability, and governance within state-owned enterprises. Critics have called for thorough investigations into the bank's financial practices to ascertain the extent of any mismanagement or misconduct.