Regular readers of this page were puzzled when after weeks of projections by analysts of a final participation rate of between 60% and 65% in Ghana's domestic debt restructuring exercise (DDE), the government triumphantly announced a “more than 80%” figure on Tuesday.

We shared our understanding on Twitter: the government was determined to announce a high participation rate and would thus adjust any necessary definitions to suit the objective, principally by altering the participation rate equation. But why is the participation rate even important in the first place?

The only reason why a government, or indeed any debtor, would seek to restructure their debt is that times are so hard for them that they cannot pay according to the original terms. A need, therefore, arises to reduce the amount they are obliged to pay from time to time, whether in interest, principal, or both.

Thus, for a debt restructuring exercise, two things matter above all else: the average haircut amount and the participation rate. The participation rate, crudely speaking, is the ratio of A) the face value of the restructured debt (so, in this case, the new bonds) to B) the face value of the original, unpaid, debt (or outstanding principal). “A” is the numerator and “B” is the denominator, yielding a basic equation: A/B. The participation rate together with the haircut amount thus determines the overall debt relief, the amount of money saved by the debtor, in this case, the government, as a result of not having to service its debt according to the original, more burdensome, terms going forward.

When setting out to restructure debt, a debtor is always conscious of the entirety of debt that can be restructured. This is what is referred to as eligible debt. Think of, say, an individual seeking to sort out their personal debt after losing their job. The bank may be willing to refinance the mortgage; a friend could be persuaded to forgive a wedding loan; but a leasing company may refuse any adjustment to the terms of the car loan. In such a situation, the mortgage and wedding loan constitute the eligible debt for that individual's restructuring effort.

When Ghana announced its debt restructuring exercise on 5th December 2022, it pegged the eligible debt being treated in the announced DDE program at roughly 137 billion GHS ($11 billion).

When things started to get rough and the government was forced to amend the offer to entice more creditors, it amended the eligible debt to roughly 130 billion GHS ($10.4 billion).

After a series of extensions, belated concessions, and veiled threats failed to break the front of holdouts smarting from the bizarre and incomprehensible failure of the government to engage creditors well ahead of the formal launch of the restructuring exercise, panic began to set in.

Finance Ministry Mandarins hunkered down with the expensive suits from Lazard Frères, the government's high-end consultants in this exercise. Over copious beverages and after much brainstorming, punctuated by the occasional exasperated stutter, a plan started to form. Ghostly smiles etched on lip corners as its simplicity and sheer elegance became clear.

The plan was that the government will choose whatever eligible debt number it wants when it wants to present the results of the DDE and do so in any way it wants. A sizzle of self-congratulatory buzz went around the room as the coup sunk in. No one leapt up to do a boogie-woogie, but the waltzing tunes from the adjoining antechamber became very audible very suddenly, stirring up some graceful head-bobbing.

Analysts who have been tracking every step of the DDE meanwhile kept issuing frantic updates to their audiences about the inevitability of a low participation rate, and thus a likely lacklustre debt relief outturn. How naïve. They completely misread the entrails. When a tenacious government used to get its way teams up with expensive, highly experienced, international consultants, a poor result is impossible!

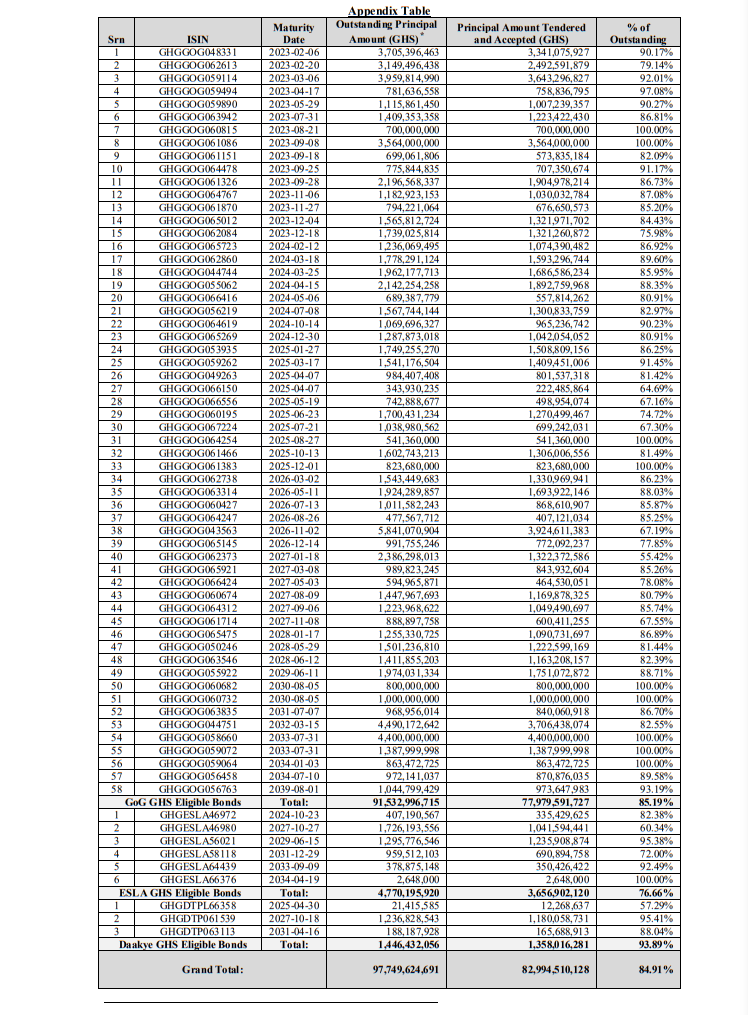

Thus it was that later today, after the earlier press release, the government issued another press release. In it, the “over 80%” figure had crystalised into an “85%” participation rate.

On the second page, the abracadabra was presented in all its glory: the government has selected eligible debt of roughly 97 billion GHS ($7.6 billion) for the purposes of calculating the participation rate.

Talk of magical mathematics!

Knowing that a few nosey people might poke around the numbers, a perfunctory sop of an explanation was thrown their way. Essentially, the government has changed its mind about what debt was eligible to be restructured. At the tail-end of the exercise. End of story.

But even amidst the cursoriness, some analysts' antenna went up. One terse justification of the last-minute reduction in eligible debt is a claim that some investors have converted their bonds into treasury bills. This could only have been done with the permission of the government. But why?

A theory doing the rounds is that it may be related to some swaps in which the government, most likely through the Bank of Ghana, is entangled. According to this theory, such derivatives are intertwined with a chunk of bonds such that any attempt to extend the maturity of those bonds would trigger serial defaults.

Whatever be the actual facts of the matter, and trust that they will be unveiled in due course, regular readers can rest assured that the debt relief analysis presented earlier still holds in its entirety.

First, using a more expansive bracket of government marketable securities (such as what was indicated in the debt exchange memoranda) as the denominator, one obtains a participation rate of between:

83 billion GHS (new bonds)/137 billion GHS (original eligible debt) = 60%

or

83 billion GHS (new bonds)/130 billion GHS (in-program amended eligible debt) = 63%.

So, analysts' projections of a rate between 60% and 65% is far more robust than the government's preferred 85%.

Does it matter?

Well, review the government's own conduct following the last deadline of the exercise. One day to the final deadline, a junior Minister announced a participation rate of 50%. Once this was reported by the Press, friendly journalists were immediately briefed undercover to start circulating a new number of 70% plus. The junior Minister was promptly instructed to stop commenting further. Government affiliates in the media then took over the narrative. This morning, the number became “over 80%”. It has finally alighted at 85%. Clearly, there would be no need to go through all these hoops if the narrative didn't matter to the government.

The universal and enthusiastic reporting of the “over 80%” and “85%” participation rates in the mainstream press without any of the nuances above is clear evidence that the participation narrative matters greatly to the government and its key audiences.

For more specialised observers however (the ones most likely to pay attention to the kind of detail often explored in these pages), a more accurate number matters for its sharper reflection on the evolving fiscal picture.

The government's PR successes are fundamentally irrelevant to such people.

Only the consequential analysis of the likely debt relief attainable from the just-ended exercise matters. Keen observers are more likely to be concerned about the fiscal hole of over $2 billion in the government's affairs that we insist can only be tackled by a sincere, independently supervised, expenditure “rationalisation” program because the current national budget doesn't go far enough.

Of course, some secondary concerns also emerge when one considers the sequence of events so far. Some of the government's explanations, self-serving though they are, also point to some disorganisation in the fixed-income market. We have earlier warned about the potential error rates of settlement due to the rush, for instance in relation to unprocessed withdrawal requests by late holdouts. Some disgruntled people exposed to the debt exchange through the actions of fiduciaries, such as banks, have been baring their teeth. In these circumstances, litigation risks still persist, notwithstanding the formal end to the program.

The government itself concedes the need to tie the loose ends of the exercise gingerly and has extended the settlement date to 21st February (to the ire of holdouts demanding a cure by 17th February of temporary defaults on the old bonds). It has unilaterally amended the exchange agreement to give it room to pursue additional exchanges and introduce mopping-up instruments, among other imminent creative responses to the underwhelming performance of the debt exchange program.

In short, the government's magic does not extend far beyond the spinning and yarning antics currently on display.