The Ghana Revenue Authority (GRA) has initiated a series of sensitization programs aimed at individuals and institutions to emphasize the importance of filing annual income tax returns before the end of April. The GRA designates April each year as Tax and Good Governance Month, focusing on educating taxpayers on income tax filing procedures and encouraging compliance.

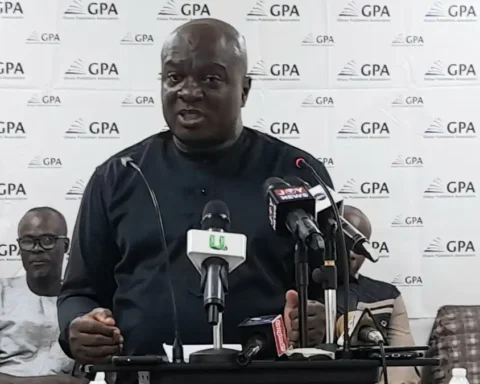

Dr. Martin Kolbil Yamborigya, Assistant Commissioner and Head of Audit for the Large Taxpayer Office, highlighted the objectives of creating awareness and reminding taxpayers of their filing obligations. He emphasized that filing tax returns not only fulfils tax payment requirements but also enables taxpayers to claim various benefits, such as child education relief, marital relief, and mortgage relief.

Moreover, Dr. Yamborigya explained that filing tax returns could lead to potential refunds in case of overpayment, with the Commissioner-General required by law to refund any overpaid tax within 60 days of establishing the overpayment.

To ensure compliance, the Revenue Administration Act was amended to allow taxpayers to disclose accurate information voluntarily, potentially waiving monetary penalties or imprisonment terms. This provision encourages voluntary compliance and is not a one-time amnesty opportunity but a continuous aspect of the law.

Dominic Adamnor Nortey, Chief Revenue Officer, addressed the taxation of resident Ghanaians earning income abroad, clarifying that the law had been in effect since 2016. He emphasized that the GRA now had sufficient information, thanks to agreements with about 170 countries for exchanging financial data, to implement the law effectively.

Nortey reiterated that all income, regardless of its source, is subject to taxation, highlighting the GRA's commitment to enforcing tax laws and ensuring compliance.