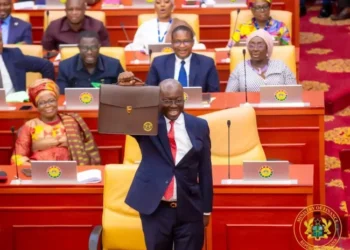

Robert Taliercio, World Bank Country Director for Ghana, Sierra Leone, and Liberia, has urged the Ghanaian government to rely more on concessional external financing from institutions like the International Development Association (IDA) rather than heavily on costly domestic borrowing for capital projects.

Speaking at the launch of the World Bank‘s 2025 Policy Notes: Transforming Ghana in a Generation in Accra on Wednesday, September 24, 2025, Mr. Taliercio emphasised that IDA loans offer far more favourable terms than domestic Treasury-bill financing.

Follow The Ghanaian Standard channel on WhatsApp for the latest news stories from Ghana.

He highlighted that short-term domestic borrowing through T-bills carried an average interest rate of 27.4 percent between 2023 and 2024, while IDA regular and blend financing attracted interest and service fees between 0.75 percent and 2.0 percent, with extended grace periods.

“Even with recent declines in average domestic borrowing costs to 11.9 percent in September 2025, new IDA blend terms offer significantly lower rates at 1.5 percent, locked in for longer periods. So it’s an obvious choice in terms of using all IDA available before resorting to further domestic financing,” he stressed.

The 2025 Policy Notes also outline Ghana’s structural challenges and propose four strategic foundations for long-term growth and inclusive transformation. The first foundation calls for restoring macro-financial stability through stronger domestic revenue mobilisation, sustainable public finances, and reforms in key sectors such as energy and cocoa.

Mr. Taliercio noted that Ghana’s tax mobilisation, at 13 percent of GDP in 2021, remains well below its estimated potential of 21 percent and the Sub-Saharan African average.